What Home Customers Required to Consider When Picking Their Following Residential Property

When you're on the hunt for your following residential property, several variables can make or break your decision. You'll also require to review the residential property's condition and how it fits your requirements.

Area: The Structure of Your Home Search

When launching your home search, location is your compass. It shapes your everyday life, influences your building worth, and determines your future. Consider what issues most to you: distance to work, institutions, or family members. Each community has its very own character, and you'll want to locate one that reverberates with your way of life.

Consider the commute. A shorter drive or convenient public transport can save you time and tension. Mirror on future development. Locations with planned developments may improve your home's value with time.

Security is another vital aspect; research crime rates to ensure you really feel safe. Do not neglect to discover prospective sound levels or traffic patterns, as these can impact your comfort. Eventually, selecting the right area establishes the stage for your home's joy and worth, so put in the time to explore and review before choosing.

Community Facilities: What's Around You

When selecting a building, consider the local colleges and instructional chances nearby; they can considerably affect your family members's future. Parks and entertainment locations likewise play a necessary function in cultivating a sense of community and providing outside activities. You'll wish to make sure that the features around you line up with your lifestyle requires.

Local Institutions and Education

Exactly how crucial is the high quality of neighborhood institutions to you? If you have youngsters or strategy to in the future, this aspect can significantly influence your residential property choice (OC Home Buyers). Excellent institutions frequently lead to much better educational end results, which can shape your kids' future. They can additionally improve your home's resale value, as lots of purchasers focus on school areas.

Research the colleges in your area prior to making a decision. You desire to really feel certain that you're making a wise investment, and recognizing neighborhood education choices is a crucial part of that process.

Parks and Recreational Areas

While quality colleges play a substantial duty in your building selection, the bordering features, like parks and leisure locations, likewise deserve your attention. Accessibility to entertainment areas can considerably boost your way of life and also increase your property's worth. Your home isn't just regarding the home; it's about the life you build around it, so choose intelligently.

Residential Property Problem: Evaluating the Framework

Assessing the structure of a building is vital for making an educated investment. When you walk via a potential home, search for signs of wear and tear, such as cracks in the walls, sagging floors, or water damage. These issues could indicate deeper architectural issues that might require costly repair services in the future. Take note of the structure, roof covering, and framework; they're important to the home's integrity.

Do not be reluctant to ask concerns regarding the home's age and any past renovations. It's likewise wise to ask for an expert evaluation, as experts can recognize concealed problems that may not show up to the inexperienced eye.

Lastly, take into consideration the materials made use of in building. Quality products can imply much less upkeep in the long run. By completely assessing the structure, you can make a more certain choice and possibly save yourself from unforeseen costs down the roadway.

Future Resale Value: Thinking Long-Term

When you're considering a building, it's vital to believe about its future resale worth. Analyzing market fads and reviewing the capacity for neighborhood development can aid you make a wise financial investment. By doing so, you'll position yourself for much better returns down the line.

Market Patterns Analysis

As you consider acquiring a residential property, recognizing market trends can greatly affect its future resale value. Study recent sales in the location to assess price trends and the time residential or commercial properties spend on the market.

Likewise, take into consideration economic variables like job development and passion prices, as these can influence customer self-confidence and purchasing power. Determine promising neighborhoods-- locations revealing signs of revitalization can supply much better resale possibility. By keeping these fads in mind, you'll make a more informed decision that lines up with your long-term investment objectives.

Area Advancement Potential

How do you establish a community's advancement possibility? Begin by researching the location's zoning laws and upcoming facilities projects. Locations with planned colleges, parks, or public transit can show growth, making your investment extra important over time. Take a look at current property sales; if prices are increasing, that's a great indicator. Talk with regional real estate agents that recognize the market dynamics. Examine for any type of city intends pertaining to growth or revitalization efforts, as my website these can impact future charm. Take note of group trends-- growing populations usually result in boosted demand for real estate. Consider the neighborhood's general charm. A dynamic community with services can improve future resale worth, making it a sensible financial investment for the long-term.

Dimension and Layout: Locating the Right Fit

When selecting your following building, think about both dimension and design very carefully. Assume concerning your lifestyle and how much room you truly need.

Don't forget storage alternatives. Enough wardrobes and cabinets can make a smaller sized home really feel even more functional. Lastly, think of future needs. Will you want even more space later? Locating the right size and design can make all the difference in exactly how you appreciate your new home. Focus on what help you and your family members's requirements.

Funding Options: Recognizing Your Budget Plan

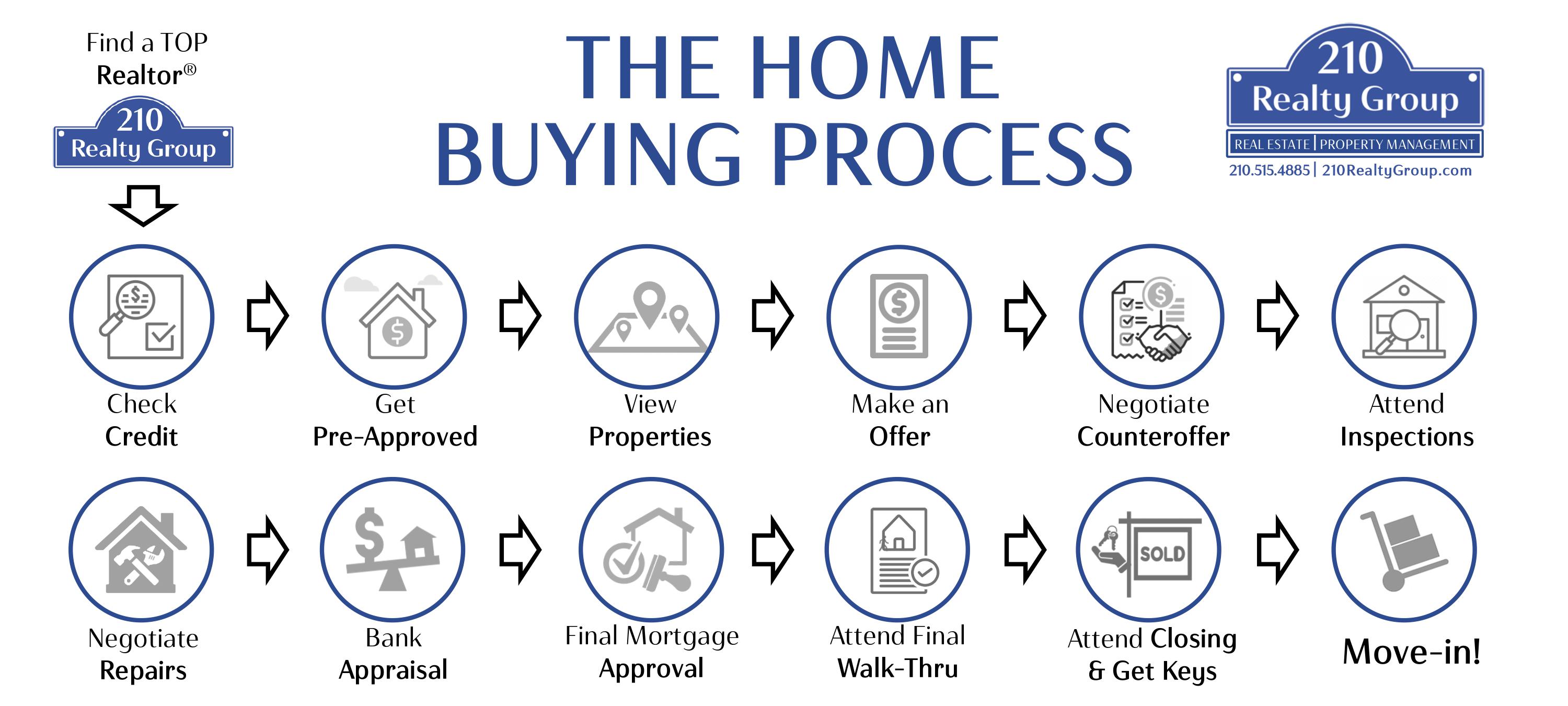

While checking out financing alternatives, you'll intend to comprehend your spending plan clearly to make educated choices. Beginning by reviewing your income, expenditures, and cost savings. This will offer you a practical view of just how much you can comfortably afford. Don't forget to variable in additional expenses like real estate tax, insurance coverage, and upkeep.

Following, consider the various kinds of lendings available. Traditional financings, FHA lendings, and VA lendings each have distinct needs and advantages. Research study rate of interest and terms, as these can substantially influence your month-to-month settlements.

Getting pre-approved for a mortgage can additionally supply clarity on your budget plan and enhance your position as a purchaser.

Ultimately, do not wait to seek advice from a financial consultant or home loan broker. They can aid you browse the intricacies of home financing and assure you're making the very best selections for your economic scenario. Recognizing your budget plan is vital to successful home purchasing.

Market Patterns: Timing Your Purchase

When's the best time to get a home? Keep an eye on market trends, as they change based on various aspects, including passion rates, seasonal demand, and financial problems.

Focus on interest prices, as well. Lower rates can save you thousands over the life of your home mortgage, so if you find a dip, it could be worth jumping in. Additionally, analyzing regional market data aids you determine whether it's a buyer's or seller's market.

Ultimately, straightening your acquisition with favorable market conditions can boost your buying power and guarantee you make a sound financial investment. So, stay educated and prepare to act when the timing's right for you.

Regularly Asked Inquiries

Just how Do I Choose In Between New Building and Older Residences?

When choosing in between new building and older homes, consider your way of life requires. New builds deal modern-day facilities, while older homes commonly have appeal and personality. Take into try this consideration upkeep, resale value, and your personal choices too.

What Are the Hidden Expenses of Acquiring a Building?

When buying a building, you'll run into concealed costs like closing costs, building tax obligations, maintenance, and insurance coverage. Don't fail to remember possible restoration expenses and utility changes. Constantly spending plan for these to stay clear of monetary shocks later on.

Should I Take Into Consideration Future Developments in the Area?

Definitely, you ought to think about future developments in the location. They can substantially influence property worths, neighborhood amenities, and your overall living experience. Watching on these changes helps you make a much more enlightened choice.

How Can I Examine the Area's Safety?

To evaluate the community's security, you ought to look into crime statistics, browse through at various times, talk with browse around here locals, and check on-line testimonials. Trust your reactions; if it feels off, it could be worth reassessing.

What Home Inspection Issues Should I Focus On?

When focusing on home inspection concerns, emphasis on architectural honesty, pipes, electrical systems, and roofing system problem. Don't ignore potential bug infestations or mold, because these can result in expensive repair services if left unaddressed.

Comments on “OC Home Buyers: How to Boost Your Credit Before Buying”